Who Gives Trade Carbon

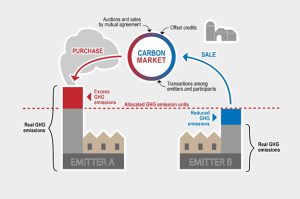

The carbon credit market has been growing in recent years. It is now estimated that it will reach a record of $6.7 billion by 2021. Companies can buy these credits to offset their greenhouse gas emissions. They can also sell them to other businesses or individuals. Unlike carbon penalties, the cost of carbon credits is largely determined by the supply and demand of the economy.

The trade carbon credits market has been driven by increased interest in climate change and the implementation of net-zero goals by corporate entities. Some countries are considering introducing cap-and-trade programs, which will add market incentives to help lessen the burden of meeting emission targets. It is important to note that cap-and-trade schemes are not voluntary. Rather, they are mandated, which means that they are not the same as the carbon offset market.

There are two types of carbon credits: regulated units and voluntary ones. Generally, regulated units are more valuable than the voluntary ones. The reason for this is that the governing body is responsible for granting the credits to certain companies within the jurisdiction. The best cap-and-trade programs provide a clear framework for reducing carbon emissions.

Who Gives Trade Carbon Credits?

In the carbon offset market, a company buys carbon credits from an environmentally conscious supplier. These are sold on an exchange platform, much like stocks are traded on a stock exchange. They are usually purchased from companies that would have made the project anyway. They can be used to offset emissions from the operations of a business, such as the transportation of goods or electricity. This method of reducing emissions is sometimes called Joint Implementation.

The regulated market is the main source of carbon credits. It is designed for companies that meet specific emissions standards. The emissions caps vary from one nation to the next. Some countries may be more strict about the maximum cap. Others have more lenient policies.

The voluntary market is a less-regulated but still active offset market. This market is based on a set of standards, which are derived from various factors. The largest component is the amount of carbon dioxide that is prevented from entering the atmosphere. Some of these credits are created by agricultural practices, while other credits are produced by industries.

The regulated market is the more complex to manage. It involves a number of risks, including unpredictable supply and demand. However, it does offer some advantages, such as lower costs. Regulatory markets are often the preferred destination for companies that are looking to reduce their emissions.

Despite the many debates over whether the market is a solution to climate change or a solution to carbon pricing, there are some benefits to using the market to offset greenhouse gas emissions. The regulated and the voluntary market are both useful tools, but it is important to remember that a well-designed market can ensure efficient and flexible funding.

As the world moves towards a net-zero future, many businesses will have to find ways to offset their emissions. While some will be able to make the necessary adjustments to reduce their carbon footprint, others will need to find another way.